Why Now Is a Smart Time to Hunt for Property in the UAE: Tips for Savvy Investors

As the UAE property market continues its strong momentum through 2025, investors both local and global are sharpening their focus on where and how to find the best deals. Recent data shows that transaction volumes are hitting record highs, with Dubai alone recording its strongest first half performance in history and overall market activity remaining robust across major emirates.

One of the first tips for anyone beginning their property search is to understand where demand is strongest. Dubai and Abu Dhabi still lead the pack in terms of price growth and investor interest, but emerging hubs in Ras Al Khaimah and Sharjah are gaining attention as infrastructure improves and lifestyle projects take shape. These secondary markets often offer more affordable entry points and potential long-term upside that isn’t yet fully priced in.

A major trend shaping property searches is the dominance of off-plan real estate projects sold before construction is completed. In 2025, off-plan deals have accounted for a substantial portion of transactions, driven by flexible payment schemes and the expectation of future capital growth. For investors with a longer time horizon, locking in units early can improve returns and provide cash-flow flexibility.

Rental yields remain attractive in many UAE communities, especially in Dubai, where gross yields can reach around 7–9% in well-chosen areas. This makes properties in zones like Jumeirah Village Circle, Dubai South, and Business Bay appealing for buy-to-let strategies. When evaluating a property, compare not just the price but also expected rental rates and occupancy levels to ensure your investment stacks up financially.

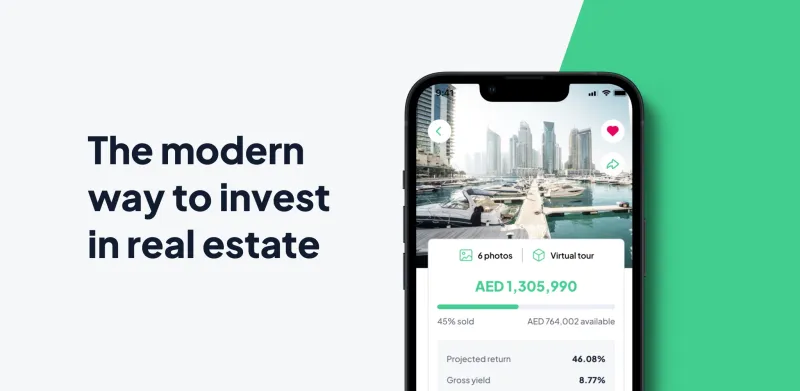

Tech innovations are also reshaping how properties are found and analyzed. Tools powered by AI and blockchain are making searches more transparent and efficient; think AI-driven valuation estimates and virtual tours that help remote investors shortlist options without visiting in person. Leaning on these digital resources can speed up research and reduce the risk of costly mistakes.

Another tip is to consider sustainability and smart living features when narrowing down your search. Developments that integrate energy-efficient systems, green certifications, and smart home tech are increasingly attractive to buyers and tenants alike, not just for lifestyle reasons, but because they often translate into higher long-term value. These features are quickly becoming the baseline expectation rather than a premium add-on.

Finally, don’t overlook the broader regulatory environment. While initiatives like the UAE’s Golden Visa continue to make property investment more appealing, it’s important to be clear on current rules such as the fact that purchasing with cryptocurrency doesn’t automatically qualify buyers for residency benefits.

Working with local agents, legal experts and market analysts can help you navigate changing policies and avoid pitfalls that could impact your investment.

Focused on delivering informative, accessible content